Shopping addiction (oniomania): signs, causes, effects, and treatment

Table of content

- What is shopping addiction (oniomania)?

- What are the signs and symptoms of shopping addiction?

- What are the causes of shopping addiction?

- What are the negative effects of shopping addiction?

- How is a shopping addiction diagnosed?

- What are the types of shopping addiction?

- What are the shopping addiction treatment options?

- What is the difference between normal shopping and shopping addiction?

Shopping addiction involves an intense urge to purchase items despite harmful effects on one’s life. Affected individuals struggle to manage spending, often buying unnecessary goods to ease anxiety or gain brief satisfaction.

The signs and symptoms of shopping addiction include frequent shopping sprees, preoccupation with shopping, inability to control spending, emotional distress, neglect of responsibilities, accumulation of debt, lying about or covering up purchases, experiencing a rush after buying something, getting new cards without clearing old debt and shopping as a response to negative emotions.

The causes of shopping addiction are neurobiological factors, low self-esteem, social pressures, easy access to credit and cultural mechanisms.

The negative effects of shopping addiction include financial difficulties, guilt and shame, exacerbation of mental health issues, hiding one’s behavior, strained relationships and potential legal issues.

Treatment options for shopping addiction include group cognitive behavioral therapy (group CBT), guided self-help (GSH), support groups, medication and financial counseling.

What is shopping addiction (oniomania)?

Shopping addiction (oniomania) is a behavioral addiction marked by an uncontrollable urge to shop and spend beyond one’s means. The condition involves a constant need to purchase things to experience excitement or emotional relief.

Various individuals feel a rush of pleasure during shopping, followed by guilt or regret once the behavior subsides. The cycle resembles a psychological addiction, where emotional triggers such as stress or loneliness fuel repeated spending episodes.

The condition is sometimes referred to as compulsive buying disorder, another term used to describe the same persistent and uncontrollable urge to purchase. People affected hide purchases, fall into debt and face relationship strain due to financial issues. The brief satisfaction from spending fades quickly, creating a cycle of shopping to regain the same feeling.

What is a shopaholic?

A shopaholic is a person who enjoys shopping to an extreme degree and struggles to limit the urge to buy. Such individuals are excessively fond of purchasing new items, typically spending more than planned or necessary.

The obsession with collecting goods or the excitement of shopping itself is the root cause of the habit. Shopaholics use buying as a way to escape stress, sadness or boredom. The pleasure from acquiring new items shifts into a sense of emptiness once the novelty disappears.

Shopaholics link personal identity or self-worth to material possessions, believing frequent purchases enhance confidence or social image. The never-ending need for additional items is more indicative of a deeper need for approval than of genuine enjoyment. For certain individuals, the act of buying replaces meaningful experiences or relationships, creating a cycle of dependence on consumption.

Is shopping addiction a real addiction?

Yes, shopping addiction is viewed as a real addiction, even though it is not formally classified as a separate disorder in the Diagnostic and Statistical Manual of Mental Disorders, Fifth Edition (DSM-5).

A 2024 study by Jon E. Grant and Samuel R. Chamberlain titled “Compulsive buying disorder: Conceptualization based on addictive, impulsive, and obsessive-compulsive features and comorbidity” stated compulsive buying disorder (CBD) has not been formally acknowledged as a distinct diagnostic condition or classified as an independent psychiatric disorder in any mental health classification system.

However, the International Statistical Classification of Diseases and Related Health Problems (ICD-11) lists the condition under “other specified impulse control disorder.” The behavior tends to dominate thoughts, influencing mood and daily functioning.

Experts note how shopping triggers the brain’s reward system in a way similar to drug or alcohol use. The absence of official recognition does not lessen the psychological and social impact of the condition.

What are the signs and symptoms of shopping addiction?

Signs and symptoms of shopping addiction refer to the indicators suggesting an individual is struggling with compulsive buying disorder. The signs and symptoms of shopping addiction are listed below.

- Frequent shopping sprees: Individuals engage in repeated buying sprees, sometimes without any clear reason or need. The act of purchasing brings a brief sense of satisfaction, encouraging more frequent shopping trips. The routine eventually becomes a habitual response to boredom or emotional discomfort. The repeated cycle strengthens dependency on shopping as a regular part of daily life.

- Preoccupation with shopping: Thoughts about buying, finding deals or visiting stores occupy much of a person’s attention. Affected persons spend hours browsing online or planning future purchases even during work or social situations. The constant mental focus interferes with concentration and productivity. Gradually, shopping becomes a dominant interest overshadowing more meaningful pursuits.

- Inability to control spending: As shopping begins, stopping feels impossible regardless of financial limits. Individuals set budgets but rarely adhere to plans, convincing themselves each purchase is justified. A 2023 article by Nyrhinen et al., titled “Young adults’ online shopping addiction: The role of self-regulation and smartphone use” revealed an indirect link between online shopping addiction and poor money management through debt. Compulsive online shoppers often show low financial awareness and recognize loss of control only after experiencing indebtedness.

- Emotional distress: Guilt, frustration and anxiety frequently follow excessive spending. The emotional turmoil intensifies by the time financial consequences become apparent. Many experience shame for an inability to stop despite repeated promises to change. Emotional strain contributes to a cycle of stress and further spending as a form of relief.

- Neglect of responsibilities: Everyday duties, whether personal or professional, fall behind as the urge to shop takes over. Missed deadlines, forgotten appointments and reduced productivity become frequent outcomes the moment buying becomes a primary focus. The imbalance affects work performance and relationships, causing frustration among colleagues and loved ones.

- Accumulation of debt: Unrestrained spending eventually results in mounting financial obligations that feel increasingly difficult to manage. Credit cards reach limits and repayment schedules spiral out of control, forcing individuals to borrow further to sustain the habit. As bills pile up, anxiety surrounding financial instability grows stronger, creating a sense of being trapped. The weight of debt becomes a constant reminder of lost control and the emotional cost of excessive spending.

- Lying about or covering up purchases: To avoid criticism or confrontation, shopping addicts resort to hiding receipts, concealing new items or downplaying expenses. Deceptive behavior becomes a way to protect the habit from exposure, reinforcing denial about the problem. A 2022 study by José Manuel Otero-López titled “What Do We Know When We Know a Compulsive Buying Person? Looking at Now and Ahead,” shared a narrative from a compulsive buyer revealing how family members, especially women, often falsified details about purchases. They tended to inflate the price of necessities like food or downplay the cost of personal items to rationalize spending habits.

- Experiencing a rush after buying something: Each purchase brings a surge of euphoria, similar to the pleasure associated with naturally rewarding activities. The excitement stems from anticipation and the sense of reward after spending, briefly masking emotional discomfort. Unfortunately, the high vanishes quickly, pushing the individual to seek the same feeling through more shopping.

- Getting new credit cards without clearing old debt: To maintain the ability to spend, individuals apply for additional credit even while carrying unpaid balances. The pattern reflects denial about financial limits and a refusal to confront existing debt. A 2021 study by Banker et al., titled “Neural mechanisms of credit card spending” revealed credit card use stimulates increased reward network activity through credit-related cues. Such cue-driven responses, independent of price, reveal how credit cards exploit reward sensitivity, encouraging excessive spending.

- Shopping as a response to negative emotions: Individuals use shopping to escape feeling upset, lonely or anxious. The act offers a brief distraction from emotional discomfort but fails to address underlying problems. According to a 2022 article by Farhat et al., titled “An Exploratory Study of Shopping to Relieve Tension or Anxiety in Adolescents: Health Correlates and Gambling-Related Perceptions and Behaviors,” negative-reinforcement shopping—marked by rising tension or anxiety eased through shopping—is linked to poor health and functioning, including substance use, violence, depression, permissive gambling views and gambling problems.

What’s it like to have a shopping addiction?

Having a shopping addiction feels like being trapped in a cycle of desire and regret. The need to shop and spend becomes overwhelming, resulting in seemingly uncontrollable impulsive decisions.

Many individuals compulsively purchase items they do not need, chasing a temporary high that goes away quickly after each purchase. The act of buying creates an illusion of happiness or relief, helping people feel good for a short while.

Once the excitement wears off, feelings of guilt, shame or emptiness emerge. Financial strain intensifies as purchases pile up faster than payments are made. Relationships suffer as loved ones express concern or frustration over excessive spending. Despite awareness of the harm caused, the pull to continue buying remains strong.

What are the causes of shopping addiction?

Causes of shopping addiction refer to the underlying factors driving an individual to engage in excessive or uncontrollable buying behavior. The causes of shopping addiction are listed below.

- Neurobiological factors: Brain mechanisms linked to reward and pleasure play a significant role in shopping addiction. When a person buys something, dopamine release creates a feeling of excitement and satisfaction. According to a 2021 article by Ravi Philip Rajkumar titled “A Biopsychosocial Approach to Understanding Panic Buying: Integrating Neurobiological, Attachment-Based, and Social-Anthropological Perspectives,” one neurobiological view of CBD links the condition to panic buying. When natural rewards from the environment become limited due to restrictions or isolation, repeated purchasing activates the mesolimbic dopaminergic pathway, creating a sense of reward and strengthening the behavior.

- Low self-esteem: Individuals with low self-esteem shop excessively in an attempt to improve self-image or feel more confident. A 2021 paper by Uzarska et al., called “Measurement of shopping addiction and its relationship with personality traits and well-being among Polish undergraduate students” revealed research links low self-esteem and materialism to compulsive buying, suggesting shopping serves as a way to boost confidence and social standing. Studies reveal a strong connection between excessive spending and narcissism, showing how purchases reflect wealth and desirable traits such as competence or intelligence. For narcissistic individuals, lavish spending functions as a self-promotion tool to project prestige. Because self-worth often depends on external validation, spending becomes a substitute for genuine self-assurance through social approval.

- Social pressures: Social expectations, peer influence and societal norms drive compulsive shopping behaviors. People are likely to feel the need to buy trendy items or keep up with friends, celebrities or influencers in order to fit in or maintain a certain image. The pressure to appear fashionable or successful leads to excessive spending, even when financial limits are exceeded.

- Easy access to credit: The availability of credit cards and online payment options removes immediate financial barriers to spending. Being able to buy now and pay later encourages impulsive decisions and weakens budget discipline. Interest-free offers and flexible credit limits further fuel the illusion of affordability.

- Cultural mechanisms: Modern culture equates material possessions with happiness, success and social value. Advertising, influencer marketing and consumer trends continuously promote the idea that buying leads to fulfilment. According to a 2024 study by Rachubińska et al., titled “Psychosocial Functioning of Individuals at Risk of Developing Compulsive Buying Disorder,” the growing rate of CBD stems from modern consumer societies that promote shopping as a leisure pursuit, offering brief mood boosts yet causing lasting harm such as debt in 58.3% of cases, unpaid bills in 41.7%, social judgment in 33.3%, and legal troubles in 8.3%.

What are the negative effects of shopping addiction?

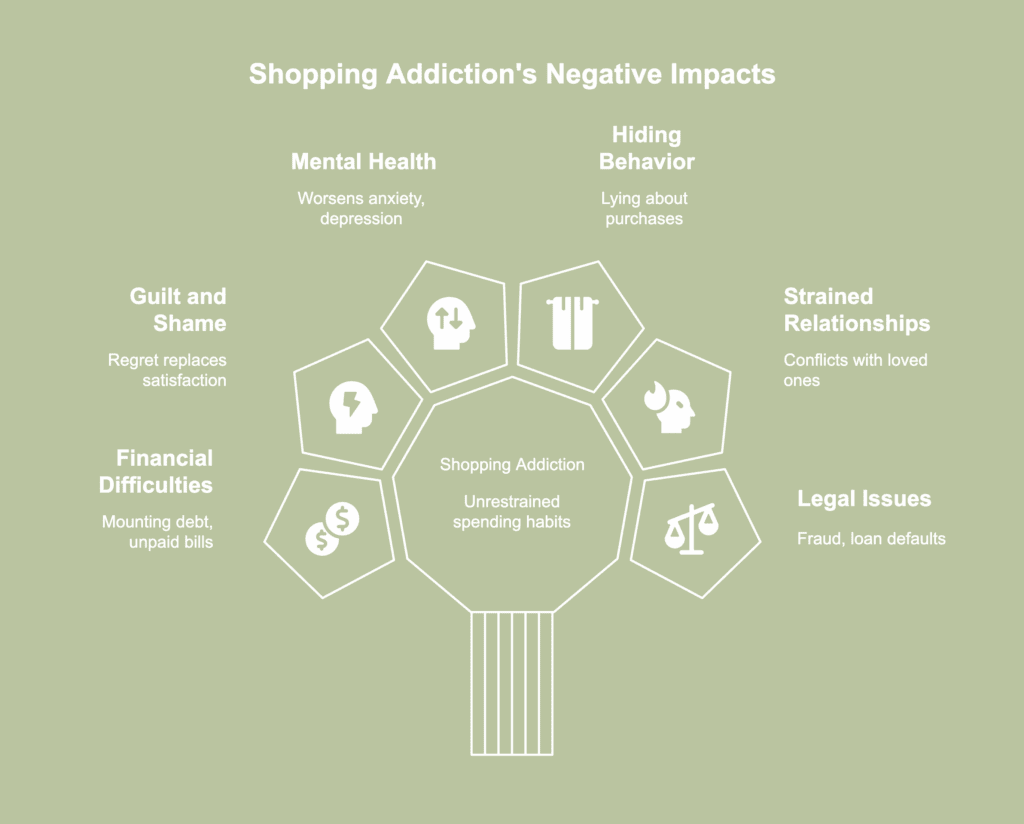

Negative effects of shopping addiction describe the harmful consequences arising from unrestrained spending. The negative effects of shopping addiction are listed below.

- Financial difficulties: Uncontrolled spending leads to mounting debt, unpaid bills and dwindling savings. The persistent urge to buy creates a borrowing-and-repayment cycle growing harder to break. Individuals with CBD begin using multiple credit cards or loans to sustain shopping habits, worsening financial instability. Financial strain triggers stress and limits access to essential needs, leaving little room for long-term security.

- Guilt and shame: After the thrill of buying fades, deep regret replaces the temporary satisfaction. Individuals begin feeling disappointed in the loss of control, questioning personal discipline and self-worth. Heavy emotions destroy confidence and contribute to a sense of failure or helplessness. According to a 2012 study by Sunghwan Yi titled “Shame-Proneness as a Risk Factor of Compulsive Buying,” shame-proneness—marked by broad negative self-evaluations driving avoidance and escape—showed a strong positive correlation with compulsive buying (CB) severity, suggesting stronger shame tendencies align with more severe buying problems.

- Exacerbation of mental health issues: Shopping addiction frequently worsens existing emotional conditions such as anxiety, stress or depression. Overspending initially seems like a coping strategy but ultimately amplifies negative emotions. The growing imbalance between emotional relief and real-life consequences creates ongoing psychological tension.

- Hiding one’s behavior: To escape judgment or confrontation, individuals start hiding receipts, lying about purchases or downplaying spending habits. Secrecy turns into a defense mechanism, intensifying feelings of isolation and guilt. The effort to maintain appearances becomes emotionally exhausting and unsustainable. Over time, dishonesty damages trust and reinforces the denial surrounding the addiction.

- Strained relationships: Conflicts with family or partners emerge as spending habits disrupt financial stability and trust. Loved ones feel betrayed, frustrated or burdened by the consequences of repeated overspending. Communication begins to break down, replaced by tension and resentment. The emotional distance created by constant arguments gradually weakens bonds and damages long-term relationships.

- Potential legal issues: Severe financial strain sometimes pushes individuals toward desperate measures such as fraud or unpaid obligations. Legal consequences arise from bounced checks, loan defaults or bankruptcy filings. The stress of legal involvement adds another layer of emotional and financial hardship.

How is a shopping addiction diagnosed?

A shopping addiction is diagnosed through a detailed evaluation of emotional patterns, spending habits and psychological symptoms. Mental health professionals begin with interviews and questionnaires to assess how often a person shops and how spending affects daily life.

Repeated urges to purchase unnecessary items or spending beyond one’s means serve as warning signs. When such actions cause distress or financial problems, clinicians consider the condition a form of behavioral addiction.

Individuals feel unable to stop, even after facing severe consequences such as mounting debt or strained relationships. Finding out if shopping is a coping mechanism for adverse emotions like anxiety or depression is the main emphasis of the diagnosis.

Professionals additionally evaluate if the compulsion leads to guilt or regret after purchases. Compulsive shopping is confirmed when buying becomes repetitive, uncontrollable and emotionally driven. Additional assessments are likely to explore coexisting issues such as depression or impulse control disorders.

What are the types of shopping addiction?

Types of shopping addiction denote the diverse manifestations or forms of compulsive buying behavior individuals tend to experience. The different types of shopping addiction are listed below.

- Flashy shopaholics: Flashy shopaholics crave attention and validation through expensive or trendy purchases. Luxurious items, designer brands and high-end accessories serve as symbols of status and self-worth. Shopping becomes a way to project confidence and gain admiration from others.

- Compulsive shopaholics: Compulsive shopaholics turn to spending as a way to manage stress or emotional pain. Shopping provides temporary comfort, replacing uncomfortable feelings with a short-lived sense of control. The relief disappears fast, leading to repeated and impulsive purchases. Emotional distress follows, trapping the individual in a cycle of spending and regret.

- Bargain seekers: Bargain seekers feel a strong rush from finding discounts, sales or limited time offers. The thrill lies not in owning the product but in securing what feels like a financial victory. Even when items are unnecessary, the idea of saving money creates a false sense of accomplishment. The pursuit for deals brings about financial strain despite the supposed “savings.”

- Trophy hunters: Trophy hunters pursue exclusive, rare or high-status items to showcase success and taste. Each purchase represents an achievement, reinforcing a self-image of sophistication and uniqueness. The value is not about the item’s use but more about the prestige associated with owning it.

- Collectors: Collectors focus on building complete sets or finding specific items fitting within a chosen category. There is a sense of order and purpose created by the thrill experienced from searching and acquiring. The collection eventually turns into a time-consuming and financially draining obsession.

- Bulimic shoppers: Bulimic shoppers engage in cycles of buying sprees followed by guilt-driven returns or purges. Emotional highs during shopping quickly turn into anxiety after reality sets in. Returning or throwing items becomes a means to regain control after excessive spending. The constant repetition of extreme actions leaves the person emotionally drained and financially unstable.

What are the shopping addiction treatment options?

Shopping addiction treatment options describe recovery methods designed to help individuals regain control over their purchasing habits. The most commonly used shopping addiction treatment options are listed below.

- Group cognitive behavioral therapy (group CBT): Group CBT focuses on identifying triggers behind compulsive shopping and reshaping unhealthy thought patterns linked to spending. The group setting encourages accountability and mutual understanding among individuals with similar struggles. A review by Müller et al., titled “Update on treatment studies for compulsive buying-shopping disorder: A systematic review” published in 2023 revealed three studies on 12-session group CBT reported strong treatment outcomes, showing 64–81% remission after therapy. Symptom reduction remained stable at the six-month follow-up. Overall, group CBT produced substantial decreases in compulsive buying–shopping disorder (CBSD) symptoms and led to marked improvements in related issues such as depression.

- Guided self-help (GSH): Guided self-help programs provide structured materials and therapist guidance to help individuals manage compulsive buying independently. Emotional cues, spending habits and self-regulation skills are all monitored by the participants. Studies comparing guided self-help with group CBT reported similar outcomes, indicating GSH serves as a less resource-demanding yet equally effective alternative for certain individuals, as noted in a 2016 paper by Hague et al., titled “Treatments for compulsive buying: A systematic review of the quality, effectiveness and progression of the outcome evidence.”

- Support groups: Support groups offer a safe, nonjudgmental space for sharing personal experiences and gaining encouragement from peers. Challenges, successes and coping strategies that enhance emotional resilience are the subjects of discussion among members. Individuals are able to recognize how they are not alone in battling addiction by hearing the perspectives of others.

- Medication: Pharmacological treatment addresses underlying mood or anxiety disorders influencing compulsive shopping tendencies. Medication works best when paired with therapy or counseling for comprehensive symptom management. Findings of a 2022 systematic review by Octavian Vasiliu titled “Therapeutic management of buying/shopping disorder: A systematic literature review and evidence-based recommendations” indicated across studies, selective serotonin reuptake inhibitors (SSRIs) such as fluvoxamine, citalopram and escitalopram produced moderate short-term benefits with 20–50% symptom reduction but showed no clear advantage over placebo in randomized trials. Remission reached 40–65% during open phases, yet relapse rose to 50–80% after discontinuation. Gastrointestinal side effects affected 10–20% of participants, contributing to dropout rates of 20–30%.

- Financial counseling: Financial counseling teaches practical money management skills while addressing emotional drivers of overspending. Counsellors guide patients in setting budgets and making informed financial choices. Structured planning restores confidence and helps rebuild financial stability. As financial control improves, emotional distress connected to compulsive spending typically decreases.

What are self-help groups for shopping addiction?

Self-help groups for shopping addiction include Spenders Anonymous and Debtors Anonymous. As a 12-step program modeled after Alcoholics Anonymous, Spenders Anonymous provides a framework for those who suffer from excessive spending.

Taking responsibility for spending patterns and creating better finance practices through shared experiences are the main focus of meetings. The group fosters personal development and motivates members to raise awareness about the recovery process from compulsive spending.

Debtors Anonymous began in 1968 after members of Alcoholics Anonymous recognized struggles linked to money and debt. The group promotes financial stability through peer support and has expanded globally to assist persons facing financial addictions.

Among the group’s stated goals are to stop unsecured borrowing, help newcomers and use peer connections to create financial stability. Through coming together in support of one another, members of both groups are able to get a handle on their spending and start over financially.

How to stop shopping addiction?

To stop shopping addiction, begin by identifying the emotions behind excessive spending and reflect on what drives the urge to shop. Reflect whether buying feels like a way to escape boredom or stress and learn to face such emotions directly instead of covering up with purchases.

Treat shopping as a necessary task, not entertainment, and avoid viewing it as a way to feel better or fill empty time. Create a realistic budget, monitor every expense and restrict access to credit cards or shopping apps making impulsive buying easier.

Spend money on essentials or experiences genuinely enhancing daily life instead of items offering a temporary high. Avoid purchases made solely for perceived bargains—if an item lacks full-price value, leave it behind.

Remove saved wish lists and unsubscribe from marketing emails encouraging unnecessary spending. Join support groups to connect with others working toward recovery. To address emotional triggers and create healthy coping strategies, get expert assistance through cognitive behavioral therapy (CBT). Swap out obsessive buying for rewarding pursuits fostering development, contentment and long-term stability.

What is the difference between normal shopping and shopping addiction?

The difference between normal shopping and shopping addiction refers to the distinct characteristics separating regular, controlled purchasing behavior from compulsive, emotionally-driven shopping. The differences between normal shopping and shopping addiction are presented in the table below.

| Difference Between Normal Shopping and Shopping Addiction | ||

| Aspect | Normal shopping | Shopping addiction |

| Purpose | Fulfills practical needs or occasional desires | Driven by emotional needs, such as stress relief or anxiety |

| Frequency | Occasional or planned shopping trips | Frequent, impulsive and often unplanned shopping sprees |

| Control | Purchases are made with restraint and within budget | Lack of budgetary control resulting in overspending |

| Emotional response | Satisfaction from fulfilling needs or getting desired items | Brief emotional high followed by guilt, regret or shame |

| Financial impact | Managed within financial means, no lasting debt | Results in financial hardship, indebtedness or the incapacity to settle outstanding debts |

| Social and personal impact | No appreciable harm to obligations or interpersonal connections | Causes conflicts with loved ones and neglect of obligations |

| Coping mechanism | Shopping is not used to cope with emotional distress | Shopping is used as a way to escape or manage emotions |

| Behavior after shopping | Items are used or enjoyed with satisfaction | Purchases are hidden, returned or left unused |

Distinguishing normal purchasing from shopping addiction helps protect emotional health and financial stability. Understanding such differences helps spot detrimental behaviors early on, allowing an affected person to get timely intervention.